The world modified in March 2020 when, in response to a killer pandemic that quickly overwhelmed the American medical system, the USA actually closed. Everybody besides first responders and different important personnel was ordered to remain at house. No college. No procuring. No outside-the-home leisure or public gatherings. As soon as-bustling cities grew to become ghost cities in a single day as residents barricaded themselves inside their houses in an effort to keep away from a lethal plague.

As a result of folks nonetheless needed to eat and replenish requirements (rest room paper, cleaning soap, hand sanitizer), important companies had been allowed to shift their operations on-line and run skeleton crews to ship merchandise or present curbside pickup service. Hashish was declared a vital enterprise in lots of communities as a result of so many residents had come to depend on its medicinal properties.

Dispensary house owners in every single place unexpectedly dusted the cobwebs off their uncared for web sites. A handful of ecommerce menu suppliers, third-party directories, and supply providers helped brick-and-mortar shops get their ships so as virtually in a single day whereas scaling their very own operations on the fly.

“Like eating places, retail had been largely the identical for hundreds of years till swiftly it modified actually rapidly,” stated Dutchie Chief Government Officer and Chairman Tim Barash, who beforehand served as chief monetary officer for cloud-based restaurant-management instrument Toast. “All of a sudden hashish commerce is altering at this breakneck velocity, and we had been simply attempting to assist our clients keep forward of the curve.”

Immediately, about 50 % of the trade’s transactions happen on-line, up from lower than 20 % pre-pandemic. This represents a substantial shakeup in how shoppers discover and purchase hashish. Nearly all dispensaries now have an internet menu tethered to their point-of-sale system that allows looking, pre-ordering, or reserving stock, with native supply or in-store pickup as success choices.

However as everyone knows, nothing is straightforward on this extremely regulated trade. Not solely are hashish corporations constrained as to how they will purchase new clients and compelled to leap by hoops to course of transactions on-line, however complicated state-by-state rules have pressured the trade to develop its personal parallel economic system of software-as-a-service (SaaS) instruments.

“In different ecommerce industries, the distributors—Shopify, WooCommerce—are fairly mature,” stated Andy Cho, newly appointed chief digital officer at multistate operator (MSO) Ayr Wellness. “In our trade, you might have all these cannabis-specific instruments to your ecommerce, advertising, and knowledge stacks, every with their very own execs and cons, and on prime of that you’ve totally different state-by-state rules on supply, order-taking, and funds. It’s a wrestle to do nationally.”

Cho beforehand oversaw ecommerce for luxurious jeweler Tiffany’s. His ecommerce-focused C-suite position at Ayr, which can be distinctive in hashish, speaks to how important the corporate considers digital gross sales platforms.

Ayr is way from alone in taking ecommerce extra significantly. In its most up-to-date earnings report, Cresco introduced it had surpassed $1 billion in on-line retail gross sales solely by the corporate’s ecommerce platform, Sunnyside. This averages out to roughly $37 million per thirty days. A latest job posting from Inexperienced Thumb Industries famous the MSO’s ecommerce program processes $400 million per 12 months.

“Your web site is your largest retailer,” stated Jeremy Johnson, head of enterprise improvement for Dispense, a menu supplier that focuses on growing search-engine-optimized belongings. “Your web site has the potential to scale exponentially in methods that can not be matched by bodily retail.”

This dynamic, the place the retailer drives enterprise by its personal web site, is comparatively new in hashish. Till Jane Applied sciences introduced the primary off-the-shelf answer to market in 2017, Weedmaps had been the first method retailers linked with shoppers on-line. Dispensaries would—and nonetheless do—pay Weedmaps an inventory price for a spot within the digital market, the place they then may benefit from being out there on one of many trade’s most-trafficked web sites. (The corporate reported a median of 5,641 month-to-month paying shoppers in its Q1 2023 earnings.)

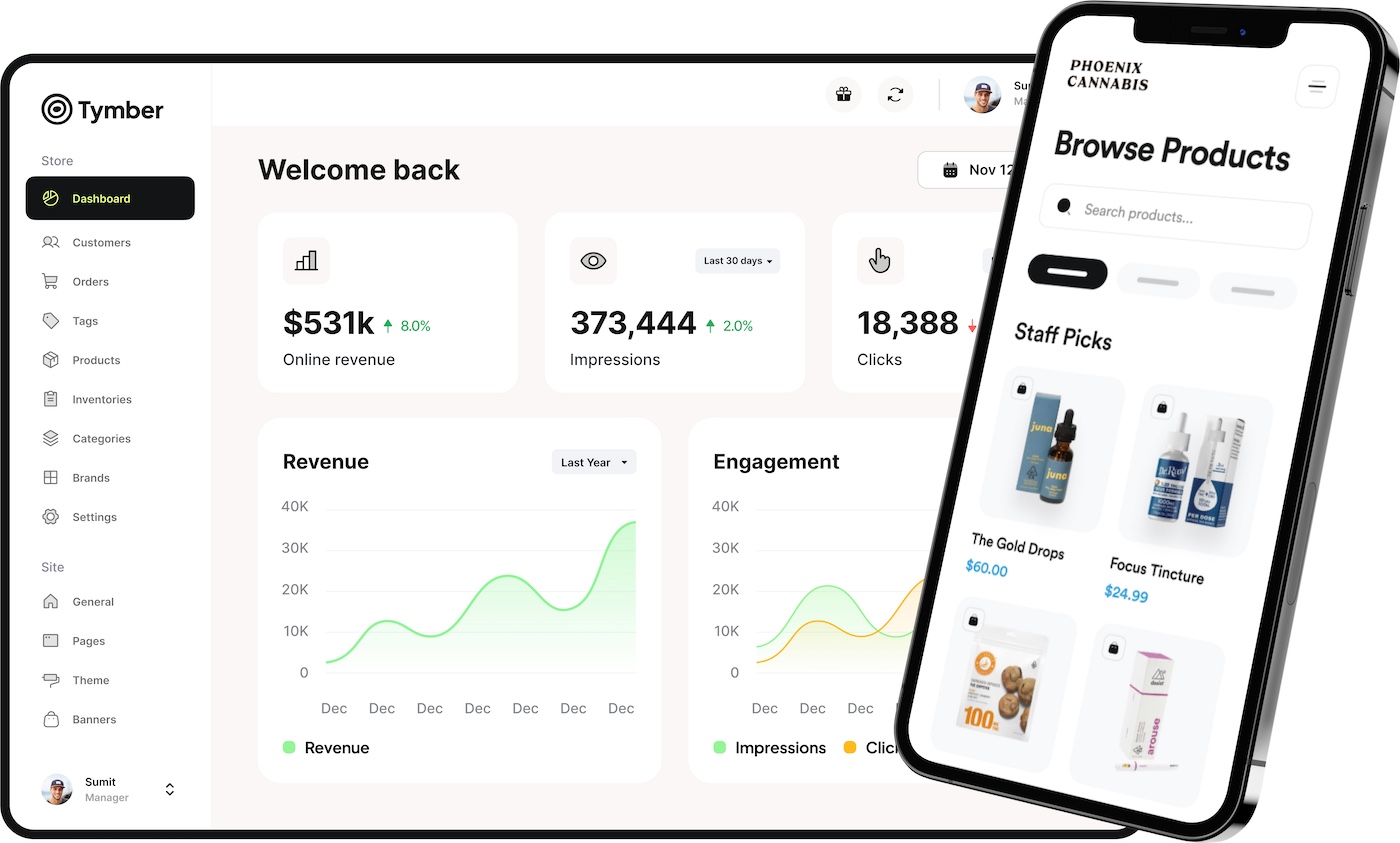

“Again within the pre-recreational days, you’d simply get a Weedmaps account, pay for promoting, and the cellphone would ring,” stated Scott Roehrick, vp of ecommerce for Blaze and founding father of SaaS ecommerce supplier Tymber (which Blaze acquired in January 2023). “Hashish retailers again then didn’t have [a digital] asset. They’d a profile on another person’s web site. In the event you stopped paying the supplier, the cellphone would cease ringing. That wanted to vary.”

Jane co-founder and CEO Socrates Rosenfeld, who on the time was working towards a grasp of enterprise administration diploma on the Massachusetts Institute of Expertise after spending seven years within the U.S. Military, noticed an immature trade that seemed extra just like the restaurant enterprise than what we contemplate conventional ecommerce. Inherent inside that state of affairs was a significant alternative.

“You had offline retailers, largely fragmented mom-and-pop operations with no potential to ship on to shoppers,” he defined. “Firms like Amazon, Shopify, Uber, and Doordash weren’t getting into the house, so we needed to actually invent a brand new method for ecommerce to be carried out.”

Dutchie launched to handle the identical drawback shortly afterward, and Weedmaps and Leafly later created embeddable variations of their market menus for dispensaries to host on their websites. The overwhelming majority of dispensaries nonetheless use considered one of these 4 options, although the suppliers now have credible competitors from upstart ecommerce suppliers like Dispense, Tymber (through Blaze), and Sweed.

Up to now, a handful of forward-thinking retailers constructed extra customized options, like Airfield Provide and Eaze. The latter started as a delivery-driven ecommerce market and has morphed right into a vertically built-in MSO with a proprietary enterprise useful resource planning platform and supply system at its core.

“After we launched in 2014, there simply weren’t off-the-shelf choices,” stated Eaze CEO Cory Azzalino. “We’re shifting to that now as a result of there are good, specialised suppliers which have the time and sources to constantly concentrate on growing their merchandise.”

Overcoming Limitations

The roadblock of being unable to just accept bank card funds looms massive because the defining problem for hashish ecommerce. The vast majority of “on-line gross sales” are the truth is preorders: The shopper reserves the product and pays on the retailer or with the supply driver, usually in money or through a cashless ATM that sometimes applies an extra cost.

Automated clearing home (ACH) funds, whereby the client connects a checking account by a 3rd get together, have emerged as a workaround, although they’re removed from good and permit connections just for debit playing cards.

In mid-2022, Dutchie launched an internet ACH fee answer that integrates with its ecommerce menu. The corporate says a few quarter of its 4,000 shoppers supply digital funds to their clients.

Jane works with Aeropay, a Chicago-based monetary know-how firm that gives safe bank-transfer funds. Whereas the platform does allow non-cash on-line funds, it’s nonetheless thought of a mere step on the trail towards the perfect of accepting digital funds like some other ecommerce platform.

“That is the most important limitation with hashish ecommerce,” stated Rosenfeld. “After we can course of bank cards and take a % of each transaction we course of, then issues get very attention-grabbing for us as an organization.”

With payment-processing challenges going through everybody within the trade, one of many large variables dispensaries are exploring to acquire an edge over rivals is easy methods to make their web sites—particularly, their menus—extra search-engine-friendly.

“There are greater than 12.5 million searches per thirty days for dispensary-related phrases,” Johnson wrote on LinkedIn, the place he frequently shares his evaluation of search engine marketing (Web optimization) and ecommerce. “‘Dispensary close to me’ is probably the most looked for by far, at 1.8 million searches per thirty days.”

Dispense and Tymber particularly assert dispensaries ought to place a premium on Web optimization in an effort to rank for searches regarding dispensaries, strains, or manufacturers. They argue commonplace iframe menus from Dutchie, Jane, and Weedmaps assist the suppliers, not dispensaries, rank for fashionable phrases.

Within the easiest phrases, an iframe is an internet site inside an internet site. The URL might say “MyDankDispensary.com,” however as a result of the menu part truly is hosted on the supplier’s server and has a separate, invisible URL, search engines like google and yahoo credit score to the supplier each phrase, picture, and tag regarding the merchandise—and all of these belongings are more and more invaluable from an Web optimization perspective.

“Iframes are in the most effective curiosity of the menu supplier, not the retailers,” stated Roehrick, who developed Tymber after a number of dispensaries requested his company for a similar factor: one thing between a high-dollar customized web site and a $200 iframe. “We wished to create a local ecommerce platform that outranks the marketplaces and iframes and will get dispensaries the advantage of having an enormous customized web site however for a fraction of the price.”

Dispense additionally constructed its product in response to the constraints of iframes. The Boston-based firm claims to provide higher natural search site visitors than its larger rivals and touts that among the many causes—which additionally embody doubtlessly rising gross sales and constructing long-term worth in search-engine-related area authority—to pay Dispense’s increased month-to-month price.

“In the event you take [MSO] Ascend for example, earlier than working with us, their in-house model Ozone didn’t rank on Google in any respect,” stated Johnson. “Within the first 100 days, we drove $210,000 in income from searches associated to Ozone. That was all site visitors that was going to Weedmaps or Leafly.”

Each Johnson and Roehrick say shoppers now seek for manufacturers and particular strains, and native menus permit dispensaries to seize these searches. In distinction, iframes permit the suppliers to seize these clients (and the information they generate).

“If I seek for ‘Stiiizy Sacramento,’ the primary consequence that comes up is [a dispensary called] Humble Root, which makes use of Tymber and Blaze,” Roehrick stated. “That comes above Stiiizy’s web site, above Dutchie.com, above Weedmaps.”

As an increasing number of retailers opted for native, Web optimization-friendly menus, Dutchie, Jane, and Weedmaps took notice and adjusted their merchandise to supply Web optimization advantages that rival Tymber and Dispense.

“We opted for iframes initially as a result of they gave us velocity to market,” stated Rosenfeld. “A few 12 months in the past we created Jane Enhance, the non-iframe model of our menu that makes use of our common product catalog, which is 1.6 million

organized extraordinarily nicely and is crawlable by Google.”Dutchie took the same path with its ecommerce menus. Recognizing the unindexable iframe was not match for function, the corporate modified its core product to supply each shopper a considerably extra Web optimization-friendly menu.

“Mainly, when the Google [web-crawling] bot exhibits up on an internet site that’s utilizing the Dutchie embedded menu, we truly can detect that, take away the iframe, and exchange it with the content material from contained in the iframe,” defined Chris Ostrowski, Dutchie’s chief know-how officer. “What that offers you is first-party content material and first-party indexing.”

Perfecting the client expertise

Getting potential shoppers to go to an internet site is one factor, however connecting them with the appropriate merchandise and maximizing their basket measurement presents an entire totally different set of challenges. Bodily shops have discovered budtenders play a vital position on this facet of retail, notably for brand spanking new shoppers, and ecommerce menu suppliers presently lack a budtender equal.

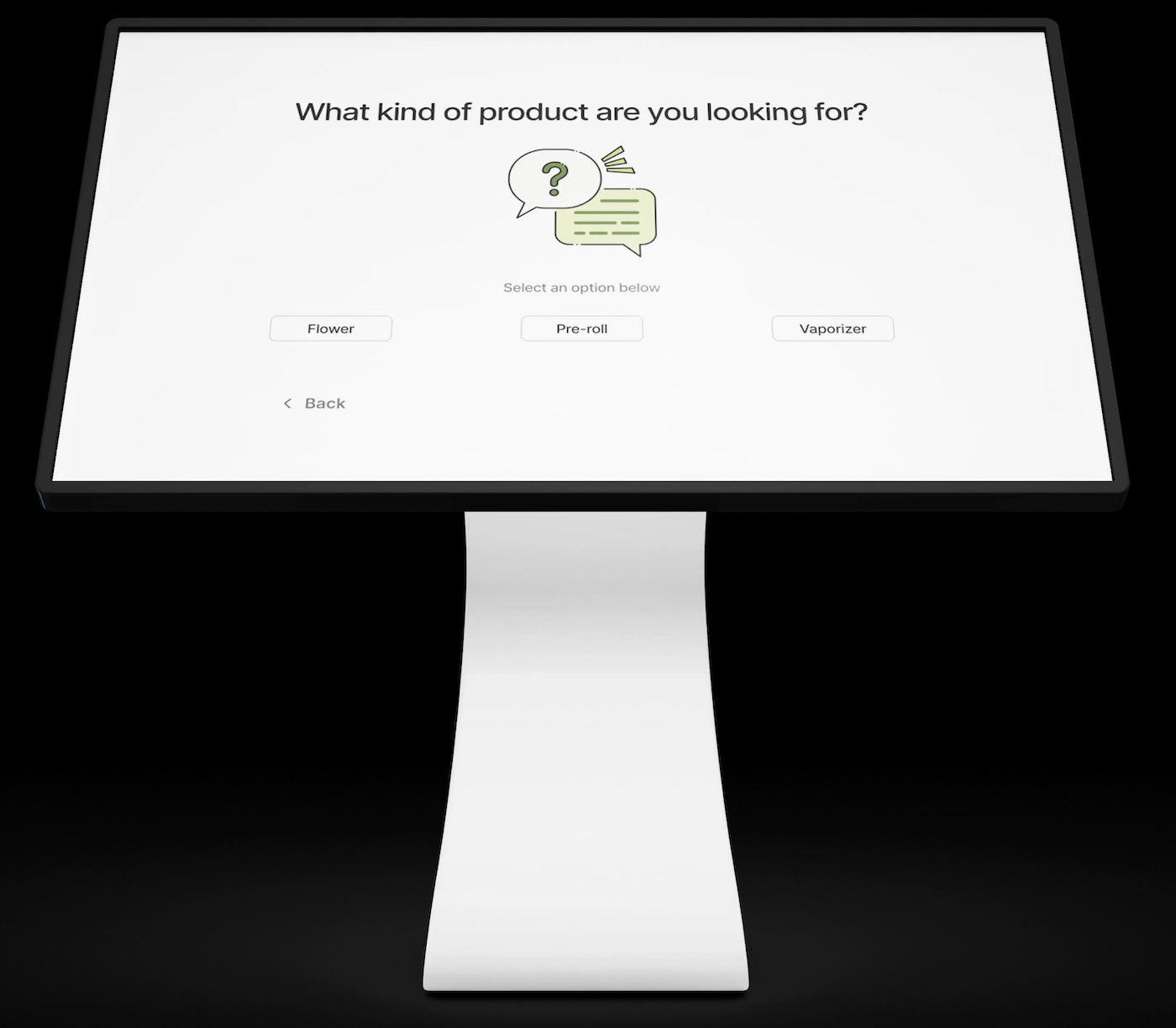

“Shopping for hashish on-line, notably for the first-time shopper, is admittedly complicated,” stated Andrew Leber, founder and CEO of StrainBrain, an artificially clever (AI) budtender that connects with ecommerce menus. “There are lots of, generally hundreds, of SKUs, and so they’re offered in rows that commoditize them and encourage procuring on value. The dearth of a budtender to information you hurts the expertise.”

Budtenders emerged as product consultants for a motive: Product choices are overwhelming and the implications of a fallacious choice will be severe, notably for brand spanking new shoppers. A foul first expertise might imply they by no means attempt hashish once more, and it is a elementary danger with unaided ecommerce looking.

“I spend a variety of time occupied with this,” stated Rosenfeld. “Expertise is just not a substitute for the in-store, human-to-human consultative expertise. It can by no means exchange that. I nonetheless wish to discuss to a human being if I’m unsure.”

AI budtenders have emerged to handle the issue. The instruments act as a widget that’s tethered to the ecommerce menu on the web site, guiding buyers with a easy move of questions that whittle down the menu to a brief, curated checklist.

“Our greater than 200 retail companions are seeing unimaginable outcomes,” stated Leber, who developed StrainBrain after turning down a chance to earn a PhD in synthetic intelligence at Oxford. “They’re rising basket measurement by a median of 25 %, seeing a 20-percent elevate in conversion, and seeing overwhelming buyer satisfaction throughout the board.”

In response to digital consulting agency TA Digital, “80 % of shoppers imagine AI-powered chatbots help them in making higher buy choices than people.” And hashish, with its obfuscated terminology and poorly differentiated merchandise, is completely suited to AI-assisted procuring.

The most important platforms are waking as much as this chance to various levels. Jane, for instance, is growing a digital budtender that may combine seamlessly with the corporate’s menu and point-of-sale system and draw on the greater than 2 million verified buyer opinions on the platform.

“Social proof is so highly effective,” stated Rosenfeld. “If you consider the way you’ve bought something on-line, if a product has hundreds of fine opinions, you’re going to purchase it and really feel fairly assured about your buy.”

Weedmaps reportedly explored constructing a digital budtender of types prior to now, however the mission was discontinued. Nevertheless, the corporate has been actively making use of machine studying to its huge repository of shopper knowledge in an effort to enhance the person expertise (UX) and product suggestions.

“Whereas we’ve had a front-row seat to shopper procuring habits since our inception in 2008, we started analyzing this knowledge throughout dozens of dimensions years in the past,” stated Randa McMinn, Weedmaps’ chief advertising officer. “We started testing machine studying to raised personalize the menu type, search, and advisable carousels in our market in early 2022.”

Ayr’s Cho goals to create a three-layer construction for Ayr’s buyer journey. On the backside is a straightforward browsable menu (presently supplied by Dutchie), the center teams collectively stock primarily based on preferences, traits, or offers, and the highest incorporates a totally customized expertise, maybe through an AI chatbot. “If we execute that stack accurately, each kind of buyer ought to have the ability to get precisely the appropriate stage of the steering they need,” he stated.

These developments in UX and AI additionally must be a boon for manufacturers, that are eager to determine higher returns on digital spend. More and more, ecommerce suppliers are creating alternatives for manufacturers to promote inside shops’ digital menus.

Of the menu suppliers, Jane has constructed probably the most refined brand-facing tech. Along with the usual banners and carousels, the corporate presents a programmatic answer that enables manufacturers to bid to indicate customers their merchandise. This function arose after the corporate decided shelf-buys in dispensaries and generic banners on ecommerce menus are imprecise automobiles for promoting.

“If I get proven an advert for gummies however I’m a flower shopper, that’s a waste of cash on the a part of the gummy firm,” Rosenfeld stated. “Our knowledge in regards to the shopper’s preferences means we will serve them adverts they’re extra prone to have interaction with, and now we have a vast variety of digital cabinets to put that advert on.”

Dispensaries that decide into the promoting program share the advert income with Jane. In response to Rosenfeld, the fifty highest-volume on-line shops generate between $1,500 and $5,000 a month. Manufacturers purchase the advert stock immediately from Jane, and the retailers haven’t any say over what adverts seem on their pages.

Dutchie has but to supply a brand-facing advert answer, however the firm insists if it does introduce such a product, it is going to place extra management within the fingers of taking part retailers. “We wish to be certain that it’s retailer-first, it’s notably clear, and it’s consensual on all sides of the transaction, which I believe is just not what you see in each case proper now,” stated Barash. “We’ve constructed an organization with retailers in thoughts. They’re our constituency, and we wish to be sure that’s who we optimize for.”

Weedmaps has allowed manufacturers to purchase advert house because the firm’s earliest days, and its providing progressively has expanded past the usual homepage carousels and banner adverts. “Merchandising is a vital a part of our market optimization, and we presently have plenty of options within the works which can be aimed toward enhancing the person expertise for shoppers whereas additionally enhancing conversion charges for our shoppers,” stated McMinn.

“Our advertising methods go nicely past competing for search phrases,” she added. “We use a wide range of advertising channels to seek out high-intent customers who convert in-store for our retailers and types. Since Weedmaps doesn’t contact the plant, now we have entry to extra channels than our plant-touching shoppers.”

The way forward for model promoting in digital retail environments might find yourself trying lots like StrainBrain’s new advert product. The AI chatbot presents SKU suggestions together with a corresponding proportion match, giving manufacturers and shoppers a significantly extra focused, customized advert. The expertise is one thing akin to incentivizing a accountable, extraordinarily well-informed budtender.

“We’re seeing a ten-times return on advert spend, which is increased than you’d get on Instagram for a non-cannabis product,” stated Leber. “At one retailer, we took a vape model from sixth within the class to second in two weeks with no discounting.”

Envisioning the massive image

It must be clear by now that each dispensary can profit from putting a higher emphasis on its digital retailer. Even when clients aren’t changing by putting an order on-line, they could take a look at the menu after which go to the related brick-and-mortar location to purchase. Poor discoverability or a lackluster person expertise hurts in both state of affairs.

The challenges related to processing transactions on-line will proceed to carry ecommerce again from its potential. ACH options like Aeropay and Dutchie Pay are actually useful, however after Mastercard introduced an entire prohibition on hashish transactions, the way forward for workarounds for conventional fee strategies stays considerably murky.

If and when the fee drawback resolves, marketplaces like Weedmaps and Leafly may pivot from charging retailers itemizing charges to taking a minimize of transactions, which may higher align incentives. Till then, a big chunk of their worth to retailers will stay their potential to attract natural site visitors, although natural site visitors to each Weedmaps and Leafly has declined by about 50 % over the previous two years, in accordance with website-marketing instruments supplier Semrush.

Dutchie and Jane supply very comparable core merchandise, and each now supply point-of-sale techniques for dispensaries seeking to home every thing underneath one roof. It’s exhausting to miss the income break up Jane presents on its model promoting, which may quantity to lots of of hundreds of {dollars} per 12 months for the most important MSOs. AI budtenders with promoting know-how inbuilt may present the opposite platforms with a fast repair for that.

Web optimization should be a precedence, notably as Google seems to skew extra closely towards native search outcomes. Each supplier claims to ship superior outcomes, so spend time digging into their claims and talking to actual clients versus simply studying preselected case research. An funding in Web optimization is an funding within the long-term well being of a enterprise.

There’s little question ecommerce presents consequential choices for dispensary house owners. Some might prioritize the comfort of working fully with Dutchie, Jane, Weedmaps, or Leafly, whereas others might really feel they will garner significant enhancements in margin whereas supporting a small enterprise like Dispense or Tymber.

With ecommerce influencing such a big chunk of gross sales, it’s gone time for dispensaries to present the know-how the eye it deserves.