Illinois’s marijuana market appears to be rebounding after a few months of lagging gross sales, with officers reporting on Monday that the state noticed practically $131 million in authorized leisure hashish purchases final month.

That’s the second highest recorded gross sales month for adult-use marijuana because the business opened in 2020.

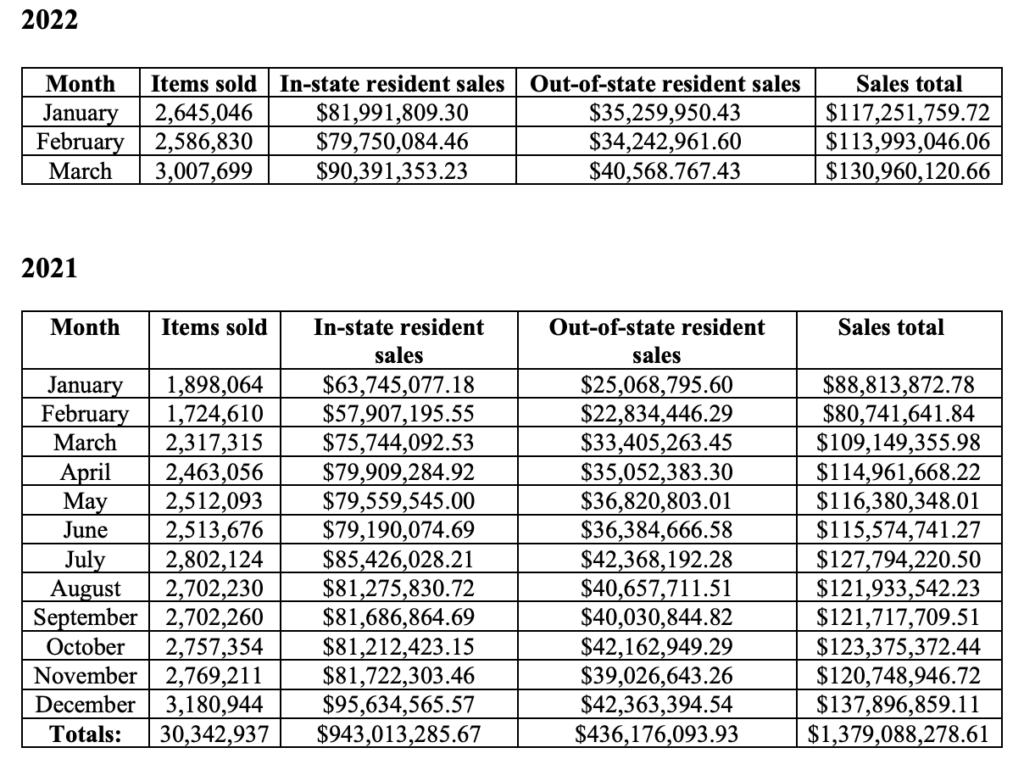

The Illinois Division of Monetary and Skilled Regulation (IDFPR) reported that there have been virtually $90.4 million in adult-use hashish gross sales from in-state customers final month, whereas about $40.6 million got here from out-of-state guests. A complete of three,007,699 particular person marijuana objects have been offered in March.

Through IDFPR.

The totals don’t embody medical hashish merchandise, that are reported individually by a special state company.

Whereas Illinois broke its yearly document for hashish gross sales in 2021—with greater than $1.4 billion in hashish offered final 12 months—marijuana purchases dipped in January and February, following the December 2021 record-high of $137,896,859.

From final 12 months’s gross sales, Illinois generated virtually $100 million extra in tax income from adult-use marijuana gross sales than from alcohol in 2021, state information discovered.

It’s unclear what elements might have contributed to the dip firstly of this 12 months, or the rebound in March.

In the meantime, an Illinois Senate committee just lately debated a invoice that might defend employees from being fired for utilizing hashish on their free time. With some exceptions, the measure would prohibit employers from firing employees or discriminating in opposition to job candidates merely for testing optimistic for marijuana use.

—

Marijuana Second is already monitoring greater than 1,000 hashish, psychedelics and drug coverage payments in state legislatures and Congress this 12 months. Patreon supporters pledging at the very least $25/month get entry to our interactive maps, charts and listening to calendar in order that they don’t miss any developments.

Be taught extra about our marijuana invoice tracker and develop into a supporter on Patreon to get entry.

—

However the invoice sponsor pulled the measure following committee the talk, saying he would return to it later. The state Home of Representatives had beforehand handed a model of the laws final month.

With respect to marijuana tax income, Illinois is utilizing a part of these {dollars} to fund fairness initiatives within the state. For instance, officers introduced in December that functions have been opening for $45 million in new grants—funded by hashish tax cash—that may assist applications meant to reinvest in communities most harmed by the drug battle.

That is the second spherical of funding to be issued by the state’s Restore, Reinvest, and Renew (R3) program, which was established beneath Illinois’s adult-use hashish legalization coverage. The regulation requires 25 p.c of marijuana tax {dollars} to be put in that fund and used to offer deprived individuals with companies reminiscent of authorized help, youth improvement, neighborhood reentry and monetary assist.

Organizations that obtained grants by the preliminary R3 spherical could have their funding renewed for an additional 12 months to make sure that they’ll proceed offering companies of their communities.

Final 12 months, in July, state officers put $3.5 million in cannabis-generated funds towards efforts to scale back violence by road intervention applications.

Along with offering such funding, Gov. J.B. Pritzker (D) introduced in 2020 that his workplace had processed greater than 500,000 expungements and pardons for individuals with low-level hashish convictions on their information.

A state-funded initiative was additionally just lately established to assist residents with marijuana convictions get authorized help and different companies to have their information expunged.

It’s most of these initiatives that Toi Hutchinson just lately advised Marijuana Second that she’s most pleased with as she transitioned from being Pritzker’s hashish advisor to the president of the nationwide advocacy group, the Marijuana Coverage Venture (MPP).

Exterior of Illinois, officers in close by Michigan officers introduced late final month that they are going to be distributing practically $150 million in marijuana tax income, divided between localities, public faculties and a transportation fund. And individually, regulators have authorised the state’s first licensed hashish consumption lounge, which is ready to open this month.

Massachusetts is amassing extra tax income from marijuana than alcohol, state information launched in January reveals. As of December 2021, the state took in $51.3 million from alcohol taxes and $74.2 million from hashish on the midway level of the fiscal 12 months.

States which have legalized marijuana have collectively garnered greater than $10 billion in hashish tax income because the first licensed gross sales began in 2014, based on a report launched by MPP in January.

California officers introduced in June that they have been awarding about $29 million in grants funded by marijuana tax income to 58 nonprofit organizations, with the intent of righting the wrongs of the battle on medicine. The state collected about $817 million in adult-use marijuana tax income in the course of the 2020-2021 fiscal 12 months, state officers estimated final summer season. That’s 55 p.c extra hashish earnings for state coffers than was generated within the prior fiscal 12 months.

In Colorado, practically $500 million of hashish tax income has supported the state’s public college system. That state introduced in a document $423 million in marijuana tax {dollars} final 12 months.