Researchers on the Brightfield Group, a distinguished cannabis-focused knowledge and client perception agency, have launched the 2022 mid-year CBD report. As a part of a brand new forecasting method, the report is reflective of two potential situations: one through which the Meals and Drug Administration (FDA) regulates the CBD market within the subsequent few years and one through which the federal company continues to delay motion. If the FDA regulates CBD by 2024, the business may see as a lot as $4.5 billion in further retail gross sales by 2027.

One key takeaway from each situations is a view of the CBD sector rising expeditiously, even when the potential for main progress is essentially depending on the FDA’s actions.

“We usually have a five-year forecast, and we try this with the idea that the FDA will certainly convey regulation,” mentioned Meg Bluth, senior director of insights at Brightfield Group. “We determined for the primary time to create two totally different situations with our forecast. One assumes that there will probably be regulation that comes about in 2024, and the opposite assumes it would proceed to be delayed.”

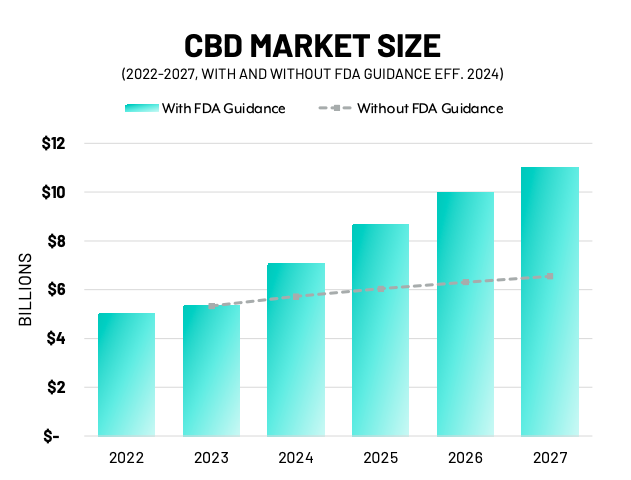

In accordance with Bluth, Brightfield expects 2022 will finish with roughly $5 billion in retail gross sales. Assuming FDA regulation is carried out by 2024, Brightfield estimates the class will herald $11 billion by 2027. Nonetheless, with out FDA regulation, the identical projections come all the way down to $6.5 billion.

The numerous progress projected underneath FDA regulation is tied to increased consolation ranges amongst customers who would see all kinds of well being and wellness CBD merchandise obtainable on the market in grocery and different conventional retail settings throughout the nation.

It appears clear to quite a few business professionals that the FDA needs to manage the sector for security and readability, and plenty of corporations are making ready for some type of nationwide regulation. “There are corporations we work with proper now which are regulating themselves a lot stronger than is required. They’re making ready to reside in a world the place they’ll proceed to dominate,” mentioned Bluth.

The report additionally dives into the product segments at present main the CBD market. For instance, tinctures stay probably the most distinguished product within the sector with probably the most utilization, accounting for 19 % of annual CBD gross sales. Gummy gross sales got here in second at 14 %, and topical gross sales got here in third at 13.6 %. Nonetheless, Brightfield portends exponential progress of the edibles class shifting ahead.

“Gummies, capsules, drinks; we anticipate these to extend, particularly with FDA regulation,” mentioned Bluth. “That’s the place you will notice the biggest progress coming in. We all know gummies inside hashish have been seeing actually robust progress.” Brightfield additionally tracks the dietary supplements sector and sees gummies as a most well-liked methodology of ingestion for wellness merchandise with CBD as a key ingredient.

The appropriate method continues to be “hurry up and wait”

In accordance with Bluth, one of many initiatives of the examine was to help companies with efficient methods to undertake at the moment whereas they look forward to FDA laws to return to fruition. “What we’ve seen with numerous CBD corporations is that they’re creating adjoining ventures for themselves.” Ever for the reason that 2018 Farm Invoice, hemp-based cannabinoids have turn out to be a viable market throughout the nation in markets the place conventional hashish merchandise are restricted.

“In regard to delta-8, some corporations are actually leaning into that and a few are dabbling. Then there’s one other group that’s actually digging into purposeful classes like adaptogens,” mentioned Bluth.

The principle impetus for aspect hustles, and even full pivots within the hashish business, is the potential to determine model recognition. Whereas companies look forward to the FDA to permit for true nationwide enlargement, they wish to be sure that clients see their model on the shelf. Nonetheless, figuring out the proper degree of funding stays a problem as a result of delta-8 is perceived as a much less fascinating substitute for conventional delta-9-THC.

“We’ve been speaking about that internally,” mentioned Bluth. “For those who take a look at the place delta-8 has its reputation, it’s in non-legal adult-use states. This leads you to consider when these states turn out to be authorized for grownup use, delta-8 will not be completely needed.”

Bluth added Brightfield believes delta-8 goes to play out as a short-term funding technique due to the complexities and associated bills related to the manufacturing of delta-8 merchandise.

After all, one thing that may’t be ignored is what’s going to occur if the FDA delays its laws additional. Bluth believes corporations ought to pay attention to this potential consequence to mitigate danger and handle expectations. “I do consider they [the FDA] will regulate, it’s a matter of when. The earliest we expect it will likely be at this level is 2024, however there are all kinds of plans inside that. It’s exhausting to say, however I do suppose it would come,” mentioned Bluth.

Be the ant, not the grasshopper

There are a selection of steps companies can take now to organize for FDA laws if and when it comes.

“Get GMP/NSF licensed, run client trials with present clients, and guarantee language and claims are correct,” mentioned Derek Chase, president of Flora + Bast, a model “based on the assumption that wellness is a way of life choice.”

In Chase’s eyes, delta-8 merchandise have a questionable foothold at finest with restricted long-term viability within the market. “I don’t suppose so, or no less than not in its present type, which is principally a loophole to get round federal legal guidelines surrounding delta-9,” he mentioned. “I feel that if D8 exhibits promise for a sure want, like sleep, then sure it’s viable. However I don’t suppose it would survive as a D9 substitute, particularly since one can formulate with as much as 13mg of THC in a 5g gummy and nonetheless be inside authorized hemp limits.”

Chase additionally added some knowledge on how he believes CBD-focused corporations ought to view themselves and their merchandise.

“I consider CBD corporations ought to cease pondering of themselves as CBD corporations, and as a substitute deal with the end-end profit to the patron that their product supplies. CBD is a function, not a profit, and customers have no idea the advantages of CBD for probably the most half. Specializing in the profit will permit CBD manufacturers to extra clearly talk their worth equation to the patron.”

Whether or not federal regulation and nationwide enlargement for CBD-related merchandise come in the end, manufacturers which are in a position to take the time to earn buyer loyalty now and place themselves for long-term success over short-term beneficial properties seem to have the successful technique in place.

In accordance with Brightfield’s most up-to-date Q2 company analysis by revenue, the market share of the highest 20 CBD corporations which incorporates Charlotte’s Internet, Your CBD Retailer (SUNMED), Medterra, and CBD American Shaman has remained largely unchanged since 2021 with little consolidation occurring through the second quarter of 2022. Nonetheless, no firm has a market share of greater than 2.5 %, displaying robust potential for brand spanking new entrants to earn substantial buyer loyalty at the moment and a bigger market share sooner or later.