With retail and wholesale hashish costs nonetheless in freefall and no federal legalization in sight, capital-raising alternatives have dried up. Actually disruptive companies will win within the brief time period because the scarce investor cash nonetheless earmarked for hashish fuels opportunistic acquisitions and ancillary enterprise fashions that scale back or take away danger for operators.

Wholesale costs in Colorado fell to $709 per pound this 12 months, hitting the bottom level because the state’s income division started reporting costs in 2014. In response to the Portland Press Herald, the common price of flower in Maine’s adult-use market has dropped 41 p.c previously two years. It’s taking place throughout the nation, and plenty of buyers are nicely conscious.

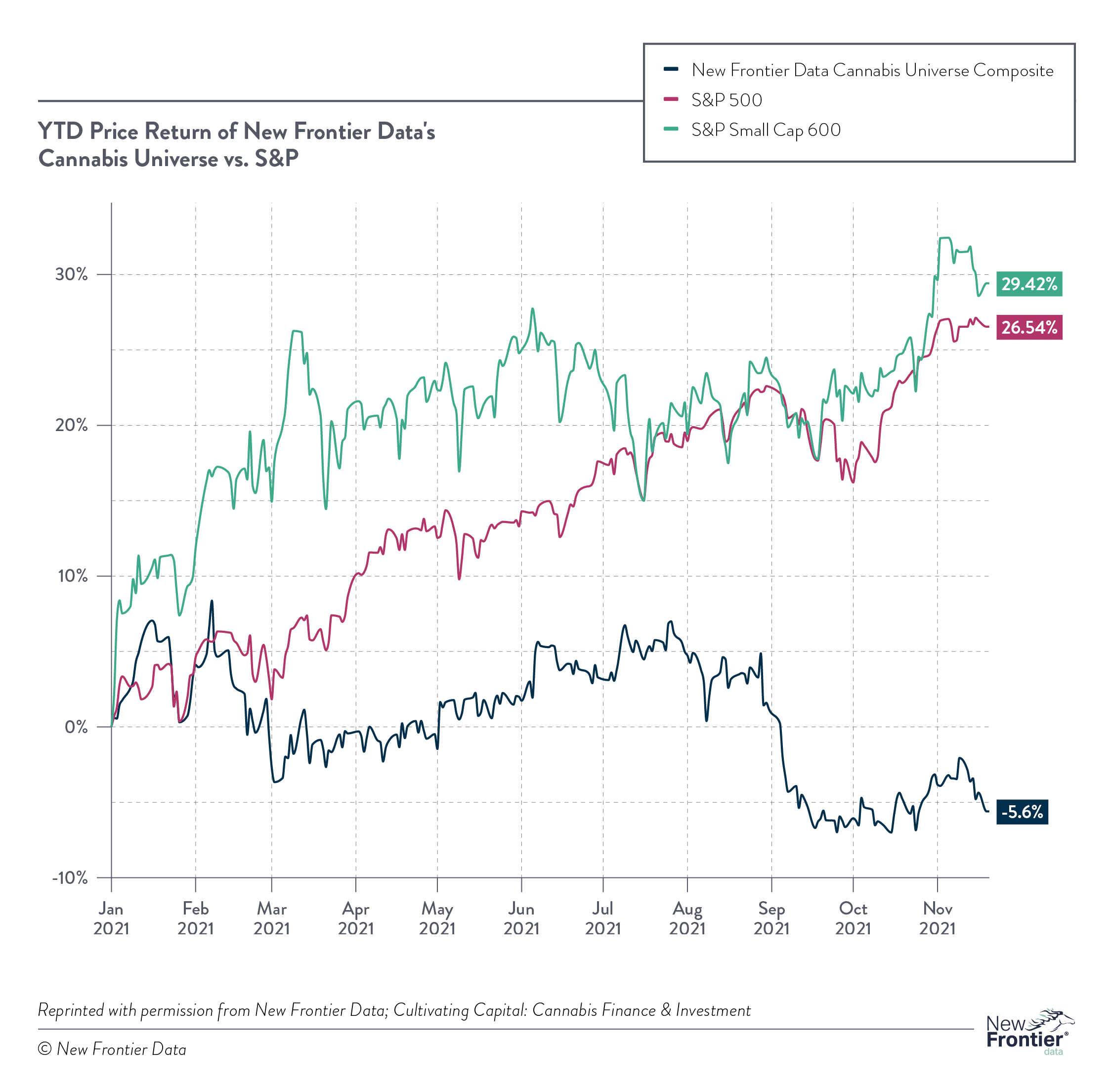

In 2021, when the S&P 500 gained greater than 25 p.c, the New Frontier Information Hashish Universe Composite (composed of public-equity costs of listed hashish firms), dropped greater than 5 p.c. The most important publicly listed multistate operators collectively raised almost a billion {dollars} in 2021, however that quantity was dwarfed by the greater than $1.8 billion in debt they carried.

Monetary issues persist in 2022. “Capital raises are down greater than 60 p.c in comparison with 2021,” Viridian Capital Advisors famous in a latest report.

Traders wish to guess on disruptors. As behemoth streaming companies gobble up cable TV clients and retail manufacturers throughout classes like footwear each enhance their share of the market and considerably develop its general dimension, the buyers who made the appropriate bets are profitable large. All of that is very true in a down or restrictive economic system, which has encircled the trade with plummeting costs compounded by inflation and client belt-tightening. Operators naturally need to scale back bills, not tackle new ones. Many retailers felt the identical hesitancy about embracing on-line advertising and marketing in its early days.

By the late Nineteen Nineties, ecommerce had taken off. Most large manufacturers had embraced promoting merchandise over the web, however investing in focused internet advertising at scale was nonetheless a brand new idea. Many retailers questioned the potential of the channel and the worth of the funding, and so they wanted to guard already skinny margins—not not like hashish retailers in the present day. As many wrestle to get by on this market, their backside traces received’t enable any extraneous funding past seed-to-sale monitoring or different required compliance-related bills. Nonetheless, this additionally limits their progress capabilities, as helpful gross sales optimization and advertising and marketing tech will get shelved. For the 83 p.c of hashish entrepreneurs already struggling to ship their message to their desired viewers, that’s a no-win scenario.

New York College estimates the revenue margins of brick-and-mortar retailers are among the many lowest, averaging simply 0.5 p.c to 4.5 p.c. On-line retail fares higher at 7.26 p.c. Whereas many predicted huge progress in ecommerce within the late Nineteen Nineties, it hadn’t but began to snowball, and plenty of large retailers initially resisted making substantial investments to scale with internet advertising. Corporations provided revolutionary applied sciences that would rework their companies, however enterprise as ordinary largely continued for a lot of risk-averse retailers.

Within the late ’90s, affiliate marketing online, the place an affiliate/writer refers on-line guests to retailers and earns a fee or reward for every sale or conversion, eliminated the danger for retailers. If no sale or agreed-upon conversion occurred, no bounty was due. Associates hardly ever have been restricted within the gross sales quantity they may drive, as a result of the retailer knew the precise price of every sale. Efficiency-based advertising and marketing businesses emerged and grew shortly. Inside a number of years of affiliate marketing online offering the cost-per-acquisition mannequin, performance-based, real-time public sale bidding in mainstream media shopping for and search-engine advertising and marketing grew to become the norm.

A slew of accounting and monetary companies corporations promote their companies for a bounty by serving to companies make sense of the worker retention credit score out there by means of the Coronavirus Assist, Reduction, and Financial Safety (CARES) Act, a payroll tax credit score out there to many hashish companies. They provide free evaluation and no up-front prices in change for a share or charge if they’re profitable. Legislation corporations exist solely to problem property-tax hikes and are compensated the identical manner. They’re assured of their capability to assist, eradicating the danger and making it simpler to turn out to be a buyer.

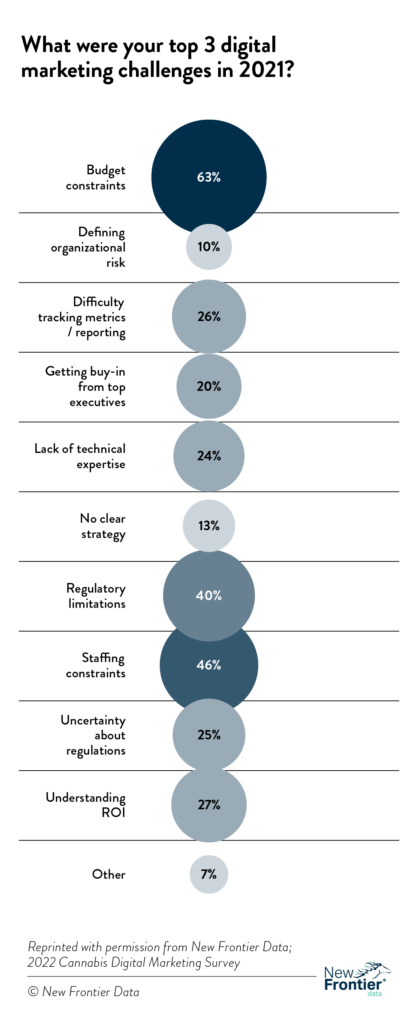

Hashish retailers may very well be asking for performance-based pricing from all of the distributors they consider will help them get by means of this tight market. With 63 p.c of hashish entrepreneurs going through vital funds constraints, decreasing or eradicating danger may make a major distinction by enabling them to increase the scope of their efforts with out up-front investments they’ll’t present.

If a packaging vendor predicts a 20-percent gross sales raise with a brand new method that appears promising, for instance, a performance-based charge may take away a lot of the retailer’s danger. Producers keen to spend money on getting their manufacturers on cabinets may scale back the danger for retailers with giant reductions or preparations to promote on consignment. Tight markets require this kind of creativity.

Convincing extra illicit-market shoppers to purchase from authorized retail retailers to assist offset the decreased spending of shoppers requires deciphering state and native laws, native consumption habits, and the distinction between what native shoppers need and what’s out there. It’s going to take a patchwork of partnerships to realize this predictive, forward-looking transformation, which complicates the performance-based pricing mannequin but in addition makes client advertising and marketing only one space of the trade that’s ripe for innovation and disruption.

With firms already providing revolutionary options and applied sciences to assist retailers succeed, near-term disruption within the hashish trade can be much less in regards to the growth of revolutionary services and extra about decreasing or eradicating danger for retailers with performance-based companies that maintain distributors accountable.

Advertising and marketing know-how professional Gary Allen serves as chief govt officer at New Frontier Data. Over the course of his profession, he has led the event of applied sciences that later have been acquired by Google, DoubleClick, Kantar Media, and different market leaders. Previous to becoming a member of New Frontier, Allen based ModernMinds, a technique consulting agency centered on startups within the know-how area.