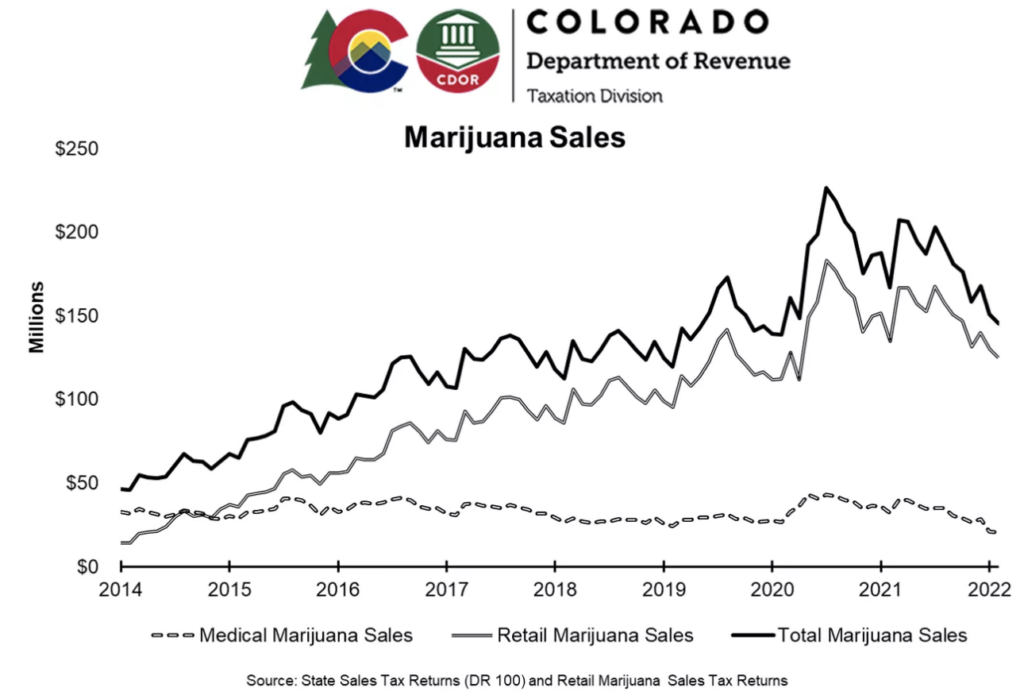

Total, hashish gross sales in February have been 3 % beneath January’s numbers and 13 % beneath whole gross sales from a yr in the past.

By Robert Davis, The Heart Sq.

Marijuana gross sales in Colorado continued a downward development in February totaling $145 million, in accordance with the state’s newest market information.

February marked the third consecutive month of declining marijuana gross sales following a record-breaking yr in 2021, the Colorado Division of Income’s (CDOR) figures present. Total, marijuana gross sales in February have been 3 % beneath January’s numbers and 13 % beneath whole gross sales from a yr in the past.

To this point this calendar yr, $296 million of marijuana has been offered within the state, bringing whole gross sales to greater than $12.5 billion since legalization in 2014.

In response to CDOR’s information, retail marijuana gross sales totaled greater than $124 million in February whereas medical marijuana introduced in one other $20 million.

Denver County accounted for almost $32 million of the retail gross sales whole, making it the very best grossing county for retail gross sales within the state. Arapahoe and Adams counties rounded out the highest three counties for marijuana gross sales, bringing in $13 million and $10 million, respectively.

Colorado additionally collected greater than $27.8 million in taxes from its marijuana gross sales in March, CDOR information reveals. Gross sales tax figures are sometimes posted a month forward of gross sales information as a result of taxes are accounted for in Colorado’s accounting system whereas gross sales figures are reported by particular person counties every month.

Tax income comes from a 2.9 % state gross sales tax on marijuana offered in shops, a 15 % state retail marijuana gross sales tax and one other 15 % state retail marijuana excise tax on wholesale gross sales and transfers of retail marijuana.

Charge income can be generated by marijuana license and software charges. Final month, Colorado made greater than $1.1 million from charges alone.

The state distributes tax income from marijuana gross sales to a number of stakeholders, a few of which embody native governments, public faculties and regulation enforcement companies.

Final month, the state retained greater than $17 million in taxes and redistributed greater than $12 million to the Marijuana Tax Money Fund, an account that helps well being care, substance abuse remedy choices, and well being education schemes.

Public faculties obtained greater than $2.1 million from marijuana taxes final month and native governments collected greater than $1.9 million from state tax redistributions, in accordance with CDOR.