NEW YORK – A potent concoction of slowing capital markets and inactivity in Washington D.C. bears nearly all of blame for the trade’s lackluster fundraising efficiency in 2023, however poor development and contracting margins are what’s actually been conserving buyers away.

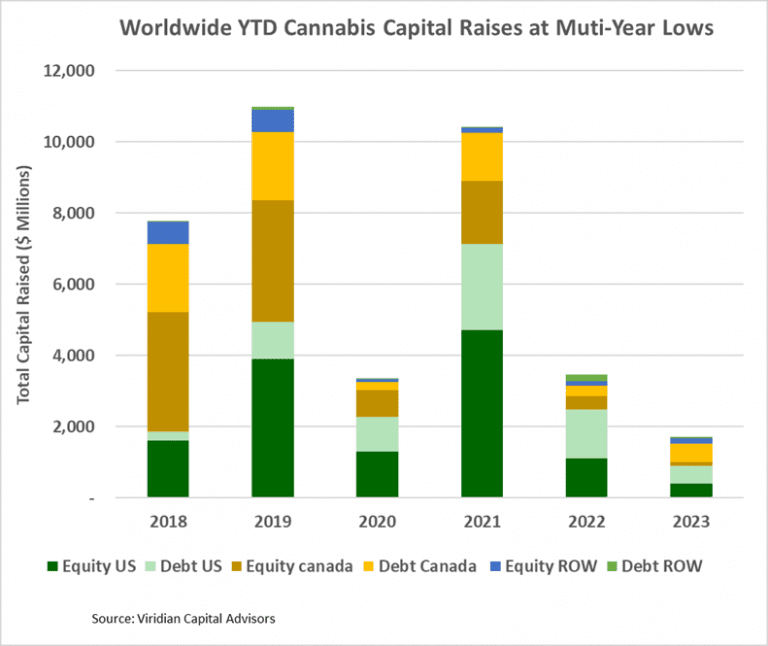

In response to the cannabis deal tracker supplied by Viridian Capital Advisors, worldwide hashish capital raises are anticipated to hit a multi-year low by the tip of December. The $1.72 billion closed by the primary 41 weeks of the yr is 50 % wanting final yr’s figures. Public corporations account for 73 % of the entire capital raised in 2023, down barely from the quantity raised in 2022 and decrease than every other interval since 2019. Making issues harder within the months to come back, debt represents 61 % of the entire capital raised, considerably greater than any comparable interval since 2018.

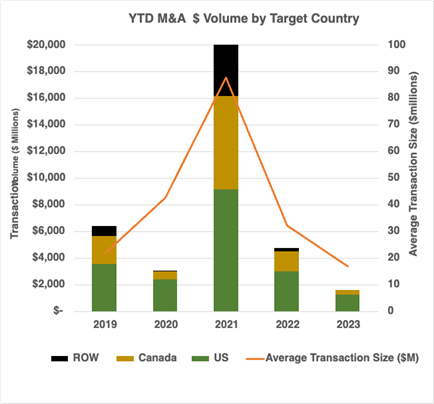

“The low exercise degree in each capital raises and [mergers and acquisitions] exercise owes rather a lot to the inactivity in Washington D.C. with regard to any form of significant hashish legislative reform and positively actions in these areas such because the SAFER Banking Act,” stated Frank Colombo, a chartered monetary analyst and the director of information analytics at Viridian Capital Advisors. “The potential rescheduling to [Schedule III] may have sturdy constructive impacts on capital elevating and [mergers and acquisitions].

“Nevertheless, the capital markets slowdown and lack of legislative reform are solely the plain factors which can be straightforward to level to,” he continued. “Much less mentioned however equally necessary is the downturn within the trade’s economics. Hashish is all the time talked about as a development trade, however consensus estimates of the 2023 revenues for the ten largest [multistate operators] present a development of solely about 1 % from 2022.”

In response to Colombo, disappointing rollouts in markets like New York, the pernicious influence of wholesale worth contraction throughout the nation, and inflationary value will increase created an ideal storm to hinder the trade’s profitability and attractiveness to growth-seeking buyers.

“The identical ten [largest] MSOs are projected to have mixture EBITDA margins of solely 24 % in 2023, down from 25 % in 2022,” stated Colombo. “And thoughts you, that is for the crème de la crème of the trade. Many smaller gamers with much less entry to capital have been going through better downturns, particularly in markets like California which have suffered better worth contractions.”

However very similar to rigorously stressing hashish crops encourages them to focus their restricted sources on producing higher buds, schwazzing may have its place in forcing corporations to strengthen the weakest elements of their operations and deal with what issues most.

To outlive in 2023, many corporations have been pressured to put off staff, exit troublesome markets, contract working capital, get rid of poorly performing SKUs, and apply far better scrutiny when exploring mergers and acquisitions. Whereas none of those steps are enticing when issues are going nicely, no trade of significance can skip its painful transformation right into a lean, imply, publicly-traded income stream worthy of recent funding {dollars}.

“The excellent news is that the trade is more likely to be stronger popping out of this era,” stated Colombo. “We’ve got at the least three main inhabitants states that are potential new grownup leisure states: Pennsylvania, Ohio, and Florida. The opening of rec markets in these states will demand capital, which is able to must be raised. Alternatively, corporations might select to broaden by acquisition. Both means, new states equals upticks in capital markets actions.”