Whether or not you’re the type of one that needs to Finish the Fed, or the type of one that needs to tax the wealthy like a Scandinavian nation, you’ll most likely agree on one factor: hashish taxation is an issue. And it’s not only a small one. It’s theft. If I (or principally anybody else) needed to decide one purpose why the trade is in freefall, it’s taxation.

280E and the last word hashish tax pitfall

Let’s begin on the federal aspect. Section 280E of the Inner Income Code prevents a hashish enterprise from making nearly any type of deduction. A couple of years in the past, the IRS clarified that hashish companies can deduct prices of products offered. However that’s it. So hashish companies are ineligible for the overwhelming majority of normal deductions obtainable to companies that promote alcohol, tobacco, opioids (as long as they’re legally prescribed after all), and a complete different slew of issues which can be objectively extra dangerous than hashish.

It’s additionally value noting that intoxicating hemp compounds aren’t topic to 280E, since hemp isn’t a managed substance. Neither is the huge unlawful market. These companies – which promote materially aggressive merchandise – pay much less in taxes and might cross these financial savings to customers. This offers them an enormous aggressive benefits. If the federal authorities cared a lot about public security, you’d suppose they’d attempt to restrict the marketplace for unlawful hashish. Nope!

State hashish taxation is everywhere in the map

In the event you thought 280E was dangerous, simply wait till we discuss in regards to the states. Each state that has legalized hashish taxes it, with out exception. They usually tax it like there’s no tomorrow. In actual fact, excessive taxes are sometimes one of many categorical guarantees that legislators or imitative drafters make. “Legalize it and we’ll make some huge cash!”

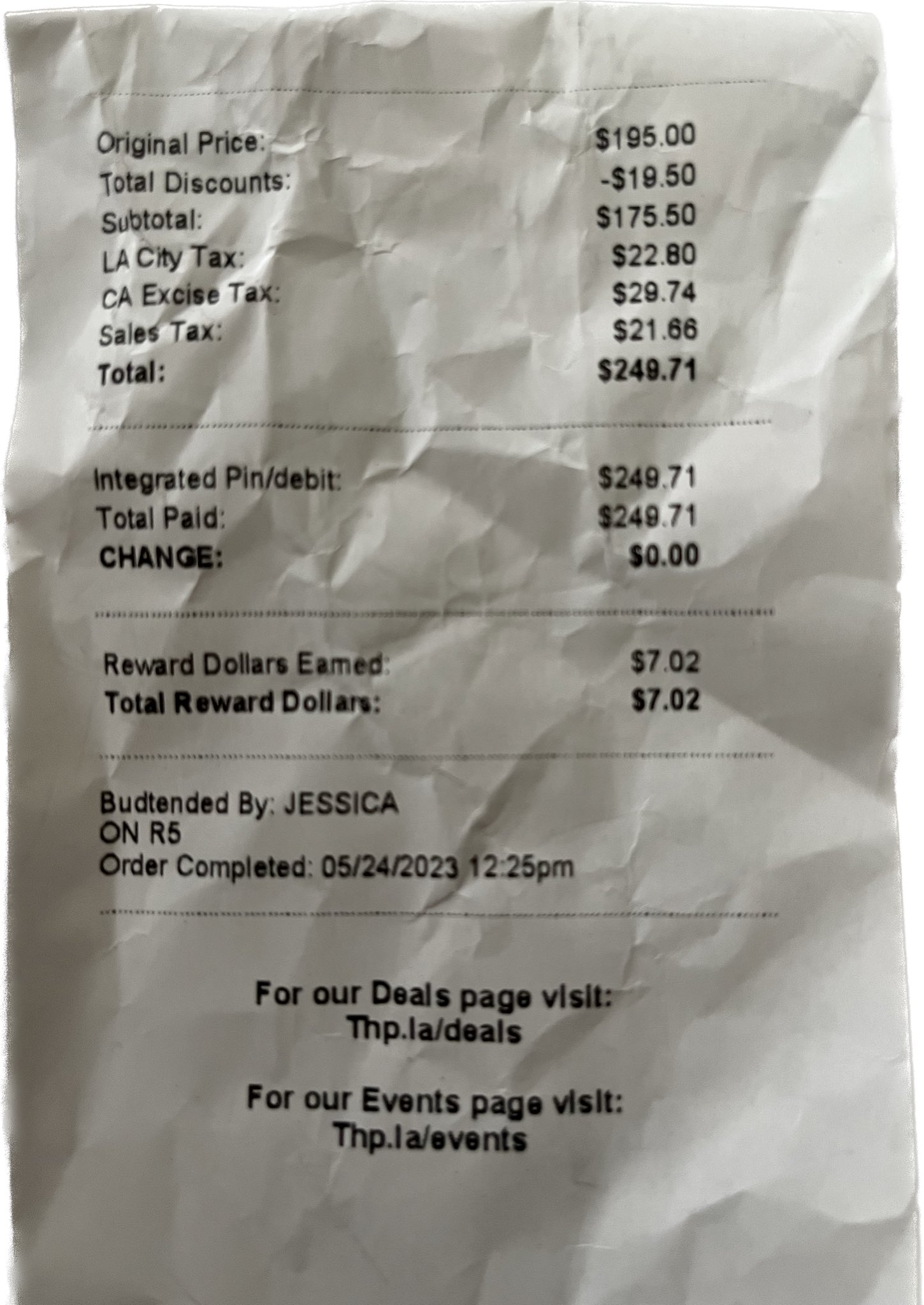

The oldsters behind California’s hashish legalization invoice, for instance, received the brilliant thought to impose each cultivation taxes and excise taxes on the trade. That is on high of the state’s regular sales tax, which has a baseline of seven.25% of the sale value – topic to will increase below metropolis/county ordinances. Earlier than the cultivation tax was ultimately eradicated, it successfully was $161 per pound! As we sit right here at present, the excise tax is 15% of the gross sales value. Right here’s a helpful picture from the oldsters at California NORML for example how excessive the excise tax is:

Credit score: Here

The above is simply excise tax, to be clear. For any sale of hashish, the excise and gross sales taxes alone will quantity to at the least 22.5%. That’s $22.50 on a $100 invoice in simply state hashish taxation. A bit of proposed California legislation would have tried to streamline among the state degree taxes to keep away from double taxation, nevertheless it looks like the bill won’t advance much further. That is fairly horrible information throughout the midst of a literal disaster inside the state’s hashish trade.

Native hashish taxation – simply while you thought it couldn’t get any worse

In California, cities usually tax hashish companies by their gross receipts. That signifies that in the event that they generate $1mm in income, they are going to be taxed some share of that income. Generally the tax is dependent upon the kind of exercise at challenge and might fluctuate throughout the state, so it is a little bit of an oversimplification. However we’ve seen hashish taxes as excessive as 10% of gross receipts. That signifies that for $1mm gross receipts taxable at that price, $100,000 can be paid as simply the town’s gross receipts tax. This doesn’t issue within the state tax (therefore the necessity for the failed invoice talked about above). Nor does it embody 280E. We’re now speaking about paying taxes on taxes.

What this seems to be like in observe

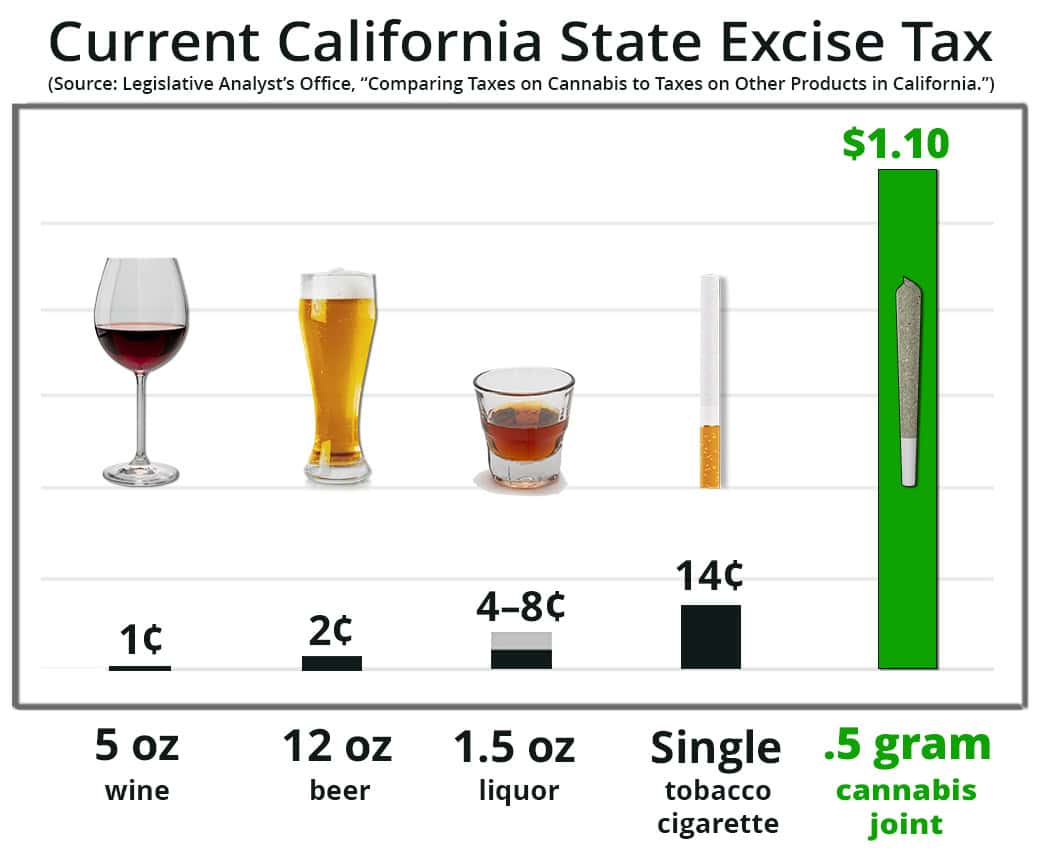

This following picture of a hashish receipt for a purchase order in Los Angeles has made the rounds on Twitter in the previous few months:

Credit score: @jgriesler

Let’s take into consideration this a bit. On a purchase order value of $175.50 (accounting for a reduction), the overall after tax is $249.71. That signifies that the tax was greater than $74. That may be a tax price of greater than 42%.

To be clear, these are prices which can be charged to a shopper. Because of this if the identical shopper had been to purchase the identical quantity of hashish (when it comes to worth) from the unlawful market, they might pay about $74 much less. In the event that they had been to purchase some type of extremely intoxicating cannabinoid product (which they may most likely do through e-commerce with out getting off the bed), they might pay about $74 much less.

Is it any surprise why the unlawful market is doing so effectively whereas established hashish companies are dropping by the wayside and going into insolvency? If the federal authorities actually cared in regards to the hashish market – a market that employs tons of of hundreds of Individuals – it may clear up this downside in 5 minutes. Even states have the ability to chop out the shenanigans and take the strain off the trade.

Hashish taxes are too rattling excessive. And till the issue is solved, don’t be stunned when the trade falls to items.