The final wave of hashish funding—what I name Hashish Funding 4.0—that kicked off in 2020 largely has been a failure for companies and collectors alike. The mix of scarce and costly capital, intensified lenders’ scrutiny, untrusted return-on-investment forecasts, and a traditionally important want for “scale or die” capital have created a lose-lose atmosphere that threatens the continued progress and maturation of the business as a complete.

It’s time to reset our strategy to hashish funding and usher in a brand new period of upper enterprise requirements and extra equitable funding and debt financing for founders, shareholders, and collectors alike. At a time when the business presents distinctive, recession-proof market alternatives, it couldn’t be extra tragic that one thing as solvable as lack of operational and monetary transparency is stopping primary capital movement.

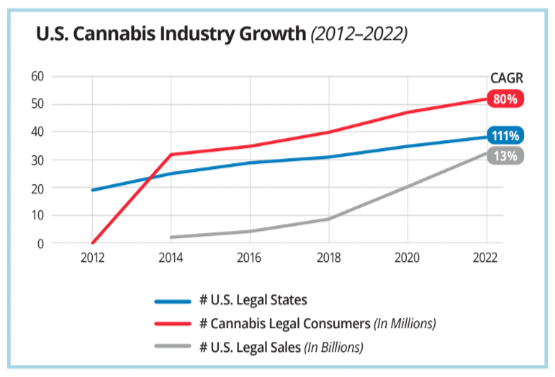

The business has shifted and developed at dramatic, arguably unprecedented pace over the previous decade and, unsurprisingly, so has its funding atmosphere. This uncommon market phenomenon reworked an unlawful observe into one of the promising industries in current historical past, and it now has a singular alternative to determine and analyze its drivers, catalysts, and hurdles to in the end form its subsequent evolutionary section.

Within the business’s infancy, high-net-worth people fueled hashish funding with angel investments of as much as $250,000 with out performing a lot due diligence. Though prices for this capital had been low, investor expectations had been excessive as startups in america dug in to get the business transferring.

Over time, funding quantities skyrocketed to upwards of $10 million as mainstream institutional buyers grew to become extra concerned. These buyers introduced extra due diligence to the business, started to boost the prices of capital, and additional ballooned their ROI expectations. The wants of hashish companies shifted in stride with these modifications, from start-up bills to natural progress to progress by acquisition.

The pandemic raised pleasure ranges and expectations even additional. Many U.S. states deemed hashish an “important enterprise,” customers spent stimulus cash on medicinal and leisure use, and inventory costs rose. Quickly after, as customers returned to extra typical routines and inflation set in, shopper spending dropped practically 10 % per transaction nationally 12 months over 12 months, in keeping with New Frontier Data. Hashish inventory costs rapidly had been impacted, capital movement started to dry up, and debt financing, the one remaining funding supply, grew to become prohibitively costly.

Because of ongoing federal prohibition, hashish companies lack entry to the sources historically accessible to operators dealing with effectivity, monetary, and/or scale challenges, together with Chapter 11 chapter and different government-subsidized alternatives to shore up capital. At the moment, as working bills mount, credit score is defaulted on, and capital is unattainable, many companies and collectors are dealing with asset liquidation and full entity dissolution, possible through receivership. For the primary time since its beginning, the business faces not solely slowing progress but additionally potential contraction.

Missing federal protections additional prohibits companies from buying extra capital on truthful phrases from different lenders. Inherent within the federal chapter debt aid processes of debt consolidation, refinancing, and different restructuring are safeguards that guarantee disclosure and transparency. When companies emerge from federal chapter, new collectors have a transparent view into their operational and monetary efficiency, permitting for potential renewed capital movement and survival of the enterprise.

Consequently, what companies, buyers, and debt holders want is the operational and monetary transparency needed to scale back funding threat, higher handle publicity, and permit cost-effective capital movement into an business on the brink of true maturation.

An funding reset should introduce and guarantee new paths to such transparency. The long-term promise of the rising U.S. and world hashish markets reveals loads of incentive for companies, buyers, and debt holders alike, and the choice is nothing in need of tragic

The business should mandate the introduction and adoption of a extra rigorous and systematic strategy to threat analysis and ongoing monitoring of companies. Operational and monetary transparency will give all stakeholders equal alternative to compete for capital and funding alternatives. Fewer shareholders will abandon their investments with out good purpose, and extra companies will keep wholesome and flourish. Economies and communities alike will profit as companies keep open and their employees keep employed.

Hashish Funding Evolution (2012–2022)

| 2012–2016 | 2016–2018 | 2018–2020 | 2020–2022 | 2022– | |

| Funding Surroundings | 1.0 | 2.0 | 3.0 | 4.0 | RESET |

| Funding Quantity | $50K+ | $1M+ | $10M+ | – | $1M+ |

| Funding Supply | HNWI | MJ-Targeted Small Funds | Household Places of work & Institutional | Excessive-Value Lenders | Fairness & Debt |

| Due Diligence | Low | Medium | Medium | Excessive | Mature |

| Funding Value | Low | Medium | Medium/Excessive | Excessive | Credit score-Score Based mostly |

| ROI Expectation | 10X | 10X+ | 15X | – | 3X – 7X |

| Use of Funds | Startup | Development | M&A | Scale & Survival | Profitability |

| Geo. Focus | U.S. | U.S. & Canada | North America & Europe | ? | World |

| Threat (Monetary & Authorized) | Low | Medium | Excessive | Excessive | Mitigated |

| OPEX | Excessive | Excessive | Excessive | Excessive | Monitored |

| CAPEX | Medium | Medium | Excessive | Excessive | Monitored |

Giadha A. DeCarcer, founding member and chief government officer at CTrust, is a seasoned tech innovator, eager strategist, and profitable serial entrepreneur who based and led New Frontier Information (2014–2021) and has spent the previous twenty years dedicated to the very best requirements of information assortment, info sharing, and total authorities and enterprise transparency.