Arizona generated extra tax income to the state basic fund from authorized marijuana gross sales than from tobacco and alcohol mixed final month, state knowledge launched final week reveals.

Tax deposits to the state basic fund from medical and adult-use hashish reached about $6.3 million in March, in comparison with $1.7 million from tobacco and $3.7 million from alcohol gross sales, in keeping with the Arizona Joint Legislative Funds Committee (JLBC).

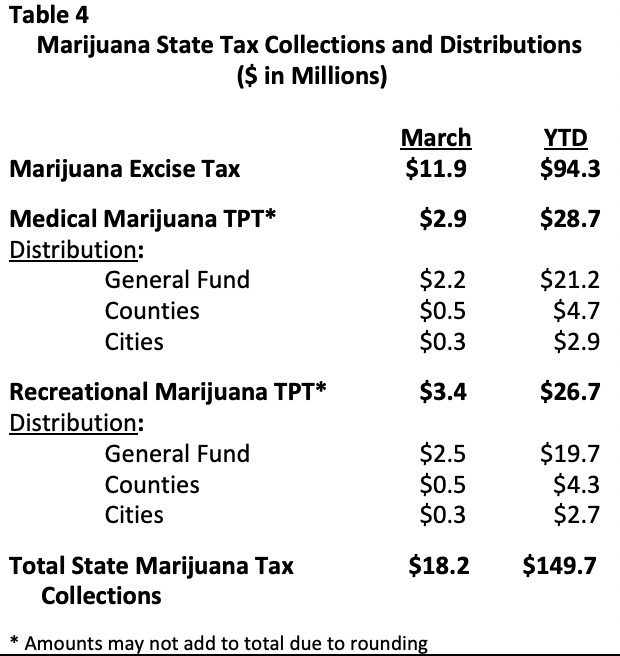

Past that $6.3 million in hashish tax {dollars} for the overall fund, marijuana excise taxes individually exceeded one other $11.9 million final month, for a complete of $18.2 million in marijuana income—most of which fits to the state, with smaller parts being distributed to cities and counties.

Advocates and stakeholders are touting the March figures. Not solely do they underscore the financial alternative of legalization, however the hope is that offering regulated entry to hashish means fewer individuals will use extra harmful medicine like alcohol and tobacco.

New JLBC numbers are out.

Tax income by trade in March:

Tobacco: $1.7m

Liquor: $3.7m

Hashish: $6.3mJoyful 420, Arizona Taxpayers!

— Arizona Dispensaries Affiliation (@az_dispensaries) April 20, 2022

To that finish, alcohol tax income did fall wanting the JLBC’s projections by $1.4 million, however the evaluation didn’t try to offer an evidence or counsel {that a} substitution impact was in play.

The report additionally notes that the state individually collected $149.7 million in marijuana tax income up to now this fiscal 12 months.

Through JLBC.

“These numbers are a transparent indication that Arizonans have totally embraced authorized hashish,” Samuel Richard, govt director of the Arizona Dispensaries Affiliation, instructed Marijuana Second. “And regardless of overly constrictive regulation and a long time of wrong-headed social coverage as limitations, tax income far outpaces different leisure classes like tobacco and alcohol.”

“Are you able to think about what the fiscal influence can be if the federal government was a associate in our success, slightly than an opponent?” he stated.

The state Division of Income (DOR) reported earlier this 12 months that Arizona noticed greater than $1.4 billion in hashish gross sales through the first 12 months of adult-use implementation. That determine contains complete gross sales for each leisure and medical marijuana.

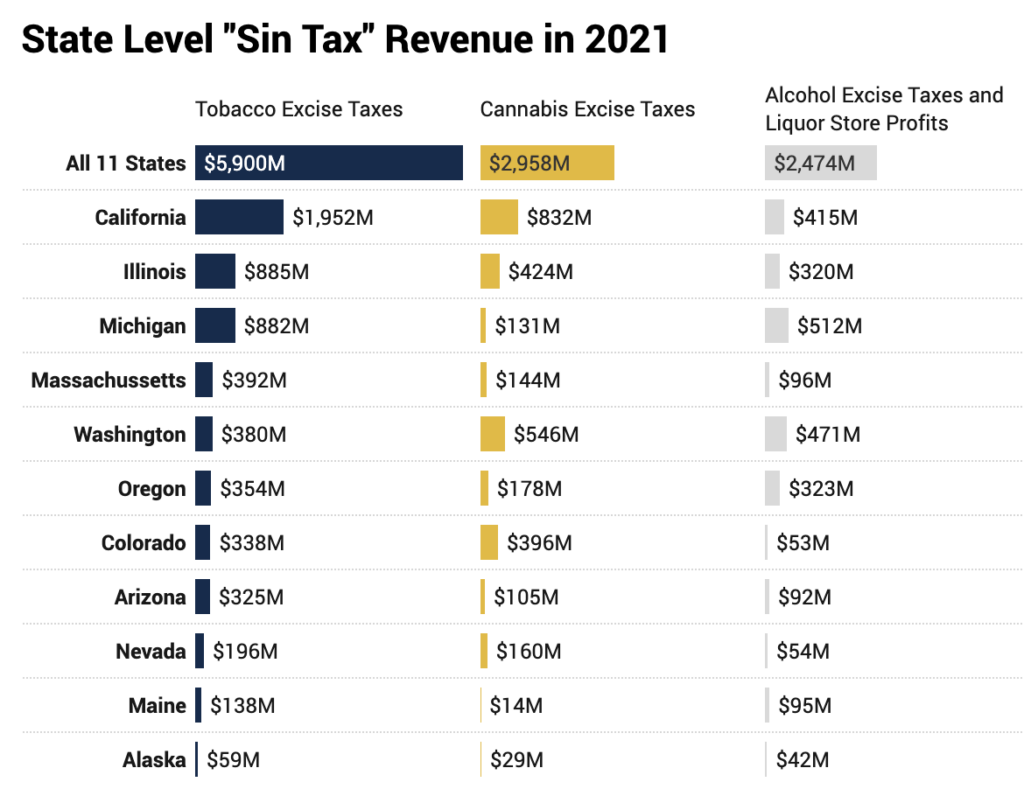

Whereas it’s unclear to what extent marijuana legalization would possibly influence alcohol use or gross sales, Arizona isn’t the one state seeing vital shifts in so-called “sin tax” income post-reform.

The Institute on Taxation and Financial Coverage launched an analysis final week that checked out 11 states which have legalized marijuana for grownup use and located that, on common, “hashish revenues outperformed alcohol by 20 %” in 2021.

Through ITEP.

Massachusetts is gathering extra tax income from marijuana than alcohol, state knowledge launched in January reveals. As of December 2021, the state took in $51.3 million from alcohol taxes and $74.2 million from hashish on the midway level of the fiscal 12 months.

Illinois additionally noticed hashish taxes beat out booze for the primary time final 12 months, with the state gathering about $100 million extra from adult-use marijuana than alcohol throughout 2021. And new knowledge reveals that Illinois’s adult-use market noticed its second highest month of hashish gross sales in March, reaching $131 million.

For what it’s value, a latest ballot discovered that extra People suppose it’d be good if individuals switched to marijuana and drank much less alcohol than suppose the substance substitution can be unhealthy.

When requested within the YouGov survey, twenty-seven % agreed that it’d be excellent if individuals used extra hashish as an alternative of booze, whereas 20 % stated that may be a foul thought.