Hashish regulation efforts are normally bought to voters or legislators with the categorical promise {that a} state will have the ability to milk the brand new business for all it’s acquired via hashish taxes. Don’t imagine me? Effectively, look no additional than California’s landmark Proposition 64, also referred to as the Management, Regulate and Tax Grownup Use of Marijuana Act. Prop. 64’s third discovering and declaration states explicitly that:

At present, marijuana progress and sale shouldn’t be being taxed by the State of California, which implies our state is lacking out on a whole bunch of hundreds of thousands of {dollars} in potential tax income yearly. The Grownup Use of Marijuana Act will tax each the expansion and sale of marijuana to generate a whole bunch of hundreds of thousands of {dollars} yearly.

In different phrases, from the inception, these packages had been designed largely to lift income for the state. And the state does so by funneling cash out of the nascent business in a particularly aggressive means – which is why I (solely form of hyperbolically) known as this theft final 12 months.

California shouldn’t be alone on this, and there are actually many different states with regressive and punitive tax schemes that each one however assure the tax-free unlawful market will thrive. However California is a primary instance of failed coverage which legislators and regulators appear intent on making worse. Right here’s why.

California’s hashish tax scheme was destined to fail from the beginning

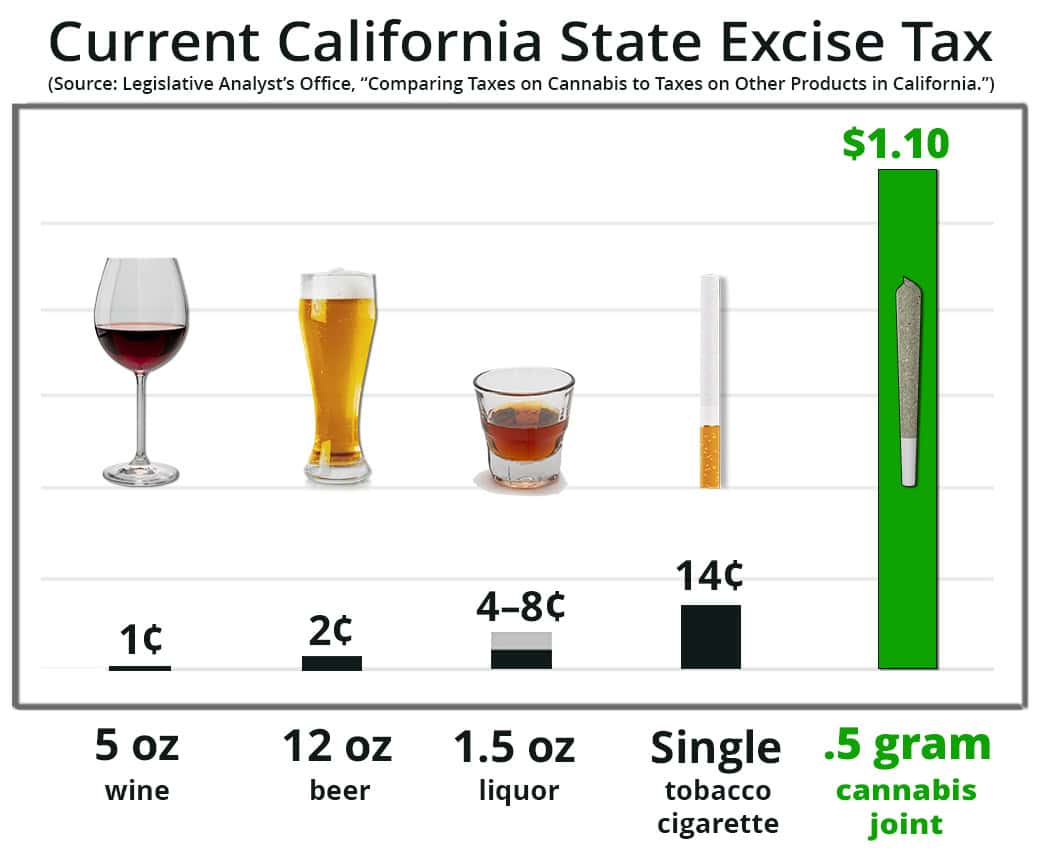

From inception, California determined to tax hashish at each ends by imposing a tax on cultivated vegetation, and an excise tax on retail. That is along with sales tax, with a 7.25% sale worth baseline and extra native add-ons.

To make issues extra, unnecessarily sophisticated, these taxes weren’t paid by cultivators and retailers, however by middlemen distributors. This meant that distributors continually needed to cope with tax points on each ends of a supply and hope they didn’t get stiffed. Heaps and plenty of distributors racked up late payments, to which the California Division of Tax and Payment Administration (CDTFA) tacked on 60% late charges and curiosity. I’m not kidding there. As I famous final 12 months, “Earlier than the cultivation tax was finally eradicated, it successfully was $161 per pound!”

This was clearly not a sustainable scenario for the business. California lastly acquired some sense and did away with the cultivation tax, however solely on a potential foundation– which means these distributors with large tax payments acquired no actual reduction. Moreover, California handed off the excise tax remittance obligation to retailers, however in doing so, successfully imposed double taxation on them. Right here’s a picture that California NORML Up to date for example:

Credit score: Here

Final 12 months, I wrote this in regards to the scenario:

The above is simply excise tax, to be clear. For any sale of hashish, the excise and gross sales taxes alone will quantity to at the least 22.5%. That’s $22.50 on a $100 invoice in simply state hashish taxation. A bit of proposed California legislation would have tried to streamline a number of the state degree taxes to keep away from double taxation, however it looks like the bill won’t advance much further. That is fairly horrible information throughout the midst of a literal disaster throughout the state’s hashish business.

That proposed invoice was held in a legislative committee and went nowhere. Proper now there is no such thing as a reduction and these issues persist. Perhaps the legislators will determine issues out within the subsequent few months, however let’s not be overly hopeful given the state’s observe file.

California tries to lift hashish taxes but once more

Final 12 months, CDTFA promulgated an “emergency” regulation relating to the excise tax. With out getting too far into the weeds, the rule would change the metric for figuring out gross receipts for the sale of hashish merchandise bought at retail, and would accomplish that in a way that might find yourself rising hashish taxes.

Catalyst, a California hashish retail firm, just lately sued the CDTFA to seek out that the emergency regulation violates state legislation. To summarize one of many claims of their swimsuit, if a vape pen retails for $40, however solely has $5 of oil in it, state legislation solely imposes a hashish tax on the oil ($5) and never on the non-oil issues. However underneath the brand new legislation, the tax could be payable on all the $40. And this, Catalyst argues, violates state legislation.

It’s not likely clear why CDTFA determined to make this transfer and immediately enhance taxes for in any other case compliant operators, when so many licensed companies are already so far in the hole. Nevertheless it highlights the truth that the state is much less fascinated about supporting its struggling business than it’s on taxing it.

California makes use of hashish taxes as a piggybank

In Prop. 64, voters had been promised that hashish taxes could be used as follows:

The revenues will cowl the price of administering the brand new legislation and can present funds to: spend money on public well being packages that educate youth to forestall and deal with severe substance abuse; practice native legislation enforcement to implement the brand new legislation with a deal with DUI enforcement; spend money on communities to scale back the illicit market and create job alternatives; and supply for environmental cleanup and restoration of public lands broken by unlawful marijuana cultivation.

Even though California pretends to care about fixing hashish taxes, it doesn’t. For instance, the state’s AG said hashish taxes could be decrease 5 months in the past, and that shockingly hasn’t occurred. In actual fact, no relief is even on the table. As an alternative, the proposed budget will truly take a “mortgage” of $100 million from the hashish tax fund to redirect to stability the state’s $38 billion finances deficit:

To deal with the projected finances shortfall, the Funds proposes Normal Fund options to attain a balanced finances. This features a budgetary mortgage of $100 million from the Board of State and Neighborhood Correction’s Hashish Tax Fund subaccount to the Normal Fund from at present unobligated sources. See the Prison Justice and Judicial Department Chapter for extra info.

If you happen to count on that “mortgage” to ever be repaid, I’ve acquired a bridge to promote you. What’s extra possible – in reality more likely – is that these “loans” will grow to be extra commonplace sooner or later and that the state will magically neglect about ever doing something to scale back the tax burden on lawful operators in order that it has this piggybank.

California’s hashish tax regime is a failed experiment. Each time a authentic, licensed enterprise shuts its doorways, statewide hashish taxes are at the least partially guilty. Till the state takes a tough and severe have a look at the difficulty, don’t count on a lot to alter with out individuals taking the state to courtroom and holding them to process.