Colorado generated extra tax income from marijuana than alcohol or cigarettes over the last fiscal 12 months, with $280 million in hashish tax {dollars} going towards a wide range of authorities applications and providers like Ok–12 training and well being care.

An evaluation from the state’s nonpartisan Legislative Council Employees (LCS) launched on Wednesday confirmed that despite the fact that annual marijuana tax income has decreased considerably over the previous two years, marijuana gross sales are nonetheless contributing extra funds to Colorado’s price range than different regulated substances.

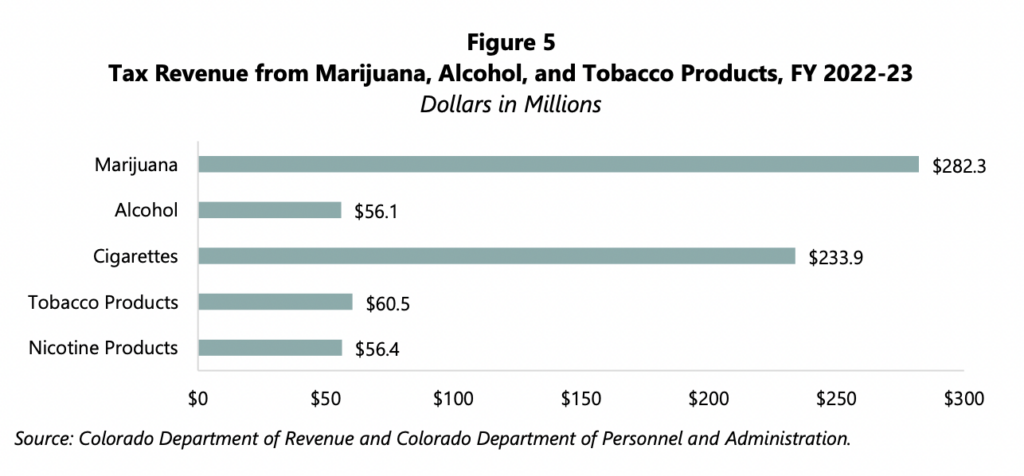

In reality, tax income from marijuana previously 12 months amounted to just about as a lot because the state generated from alcohol ($56 million) and cigarettes ($234 million) mixed. Hashish tax income additionally surpassed that of non-cigarette tobacco merchandise ($61 million) and nicotine merchandise ($56 million) in Fiscal Yr 2022-2023.

By way of LCS.

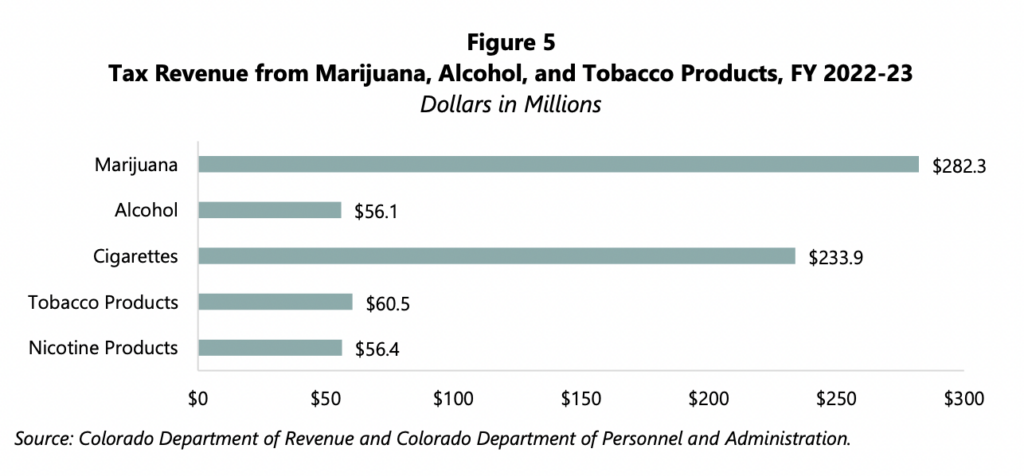

The LCS financial evaluation additionally particulars how the state is spending its hashish tax income, with cash being divided amongst a number of applications, akin to substance misuse remedy, early childhood literacy, youth mentorship and bullying prevention, regulation enforcement coaching, inexpensive housing, analysis and illicit market interdiction.

Listed here are some examples of how the hashish income is being spent for the present fiscal 12 months:

- Ok-5 Social and Emotional Well being Pilot Program: $2.5 million

- Faculty Bullying Prevention and Training: $1 million

- Psychological well being providers for juvenile and grownup offenders: $6.1 million

- Inexpensive Housing Development Grants and Loans: $15.3 million

- Black market marijuana interdiction/state toxicology lab: $4.4 million

- Marijuana impaired driving marketing campaign: $1 million

- Substance abuse prevention: $10.1 million

- Pesticide management and regulation: $1.2 million

“Taking into consideration the statutory distributions and the [Marijuana Tax Revenue and Education] appropriations, Ok-12 training acquired about 37 p.c of complete spending from marijuana income for varsity funding and faculty building,” the report says. “The Division of Human Companies acquired about 20 p.c for a wide range of applications, together with these centered on behavioral well being and habit.”

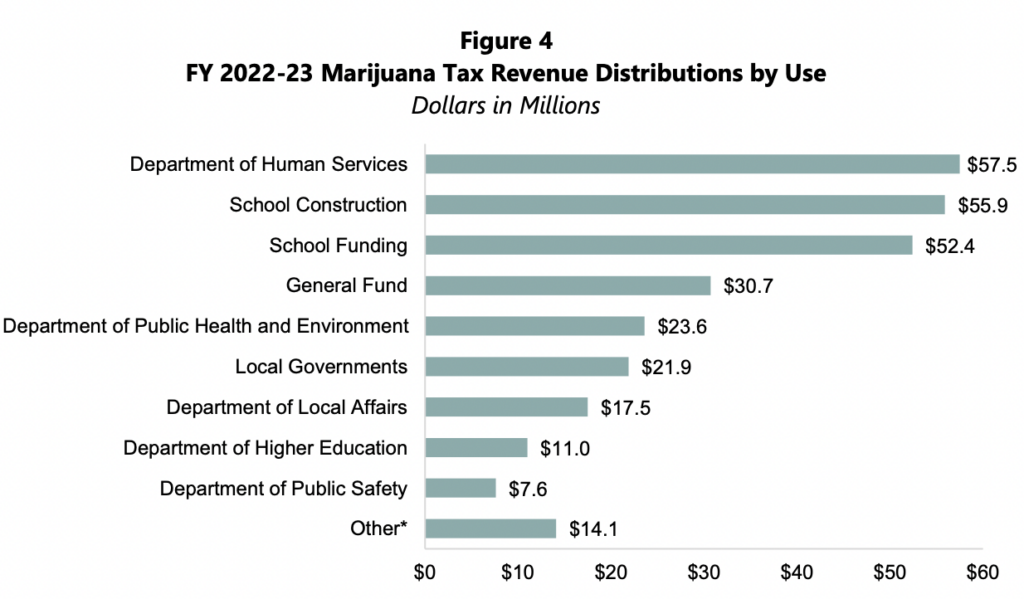

By way of LCS

The income comes from two distinct taxes which can be imposed on adult-use marijuana merchandise: a 15 p.c excise tax and a 15 p.c particular gross sales tax. The full additionally consists of income from the sale of medical hashish merchandise, that are topic to a 2.9 p.c gross sales tax.

The state’s complete yield for this previous 12 months was down about $140 million in comparison with its excessive of about $425 million in 2021, with income returning to Fiscal Yr 2018–2019 ranges as gross sales decreased.

By way of LCS.

This isn’t the primary time that Colorado has seen hashish tax {dollars} outpace that of alcohol or cigarettes. A separate evaluation printed final 12 months additionally noticed that development in each Colorado and Washington State through the 2021–2022 Fiscal Yr. One other eight states generated extra tax income from marijuana than cigarettes throughout that point interval, as nicely.

In Arizona, the state generated extra tax income to the final fund from authorized marijuana gross sales than from tobacco and alcohol mixed in March 2022.

Massachusetts additionally began gathering extra tax income from marijuana than alcohol, state knowledge launched final 12 months reveals. As of December 2021, the state took in $51.3 million from alcohol taxes and $74.2 million from hashish on the midway level of the fiscal 12 months.

Illinois noticed hashish taxes beat out booze for the primary time in 2021, with the state gathering about $100 million extra from adult-use marijuana than alcohol that 12 months.

A ballot launched by the American Psychiatric Affiliation final month discovered that adults contemplate marijuana to be considerably much less harmful than cigarettes, alcohol and opioids. Respondents mentioned hashish is much less addictive than every of these substances, in addition to know-how.

Relatedly, a Gallup ballot launched this month reveals that totally half of People have tried marijuana, and extra individuals now actively smoke hashish than cigarettes.

—

Marijuana Second is monitoring greater than 1,000 hashish, psychedelics and drug coverage payments in state legislatures and Congress this 12 months. Patreon supporters pledging at the least $25/month get entry to our interactive maps, charts and listening to calendar in order that they don’t miss any developments.

![]()

Study extra about our marijuana invoice tracker and change into a supporter on Patreon to get entry.

—

A Colorado regulation that enables for on-line marijuana gross sales formally took impact this month, giving customers a brand new methodology of ordering hashish greater than a decade after the state enacted legalization.

Gov. Jared Polis (D) additionally not too long ago signed laws that can bolster marijuana-related protections for working professionals within the state, successfully codifying an government order he issued final 12 months.

In Could, he signed one other invoice to create a regulatory framework for authorized psychedelics underneath a voter-approved initiative.

Polis mentioned in an interview this month that his state’s strikes to legalize marijuana and psychedelics have resulted in a “superb” expertise—and he believes that adults broadly ought to have the appropriate to make selections for themselves about utilizing medicine.

The submit Colorado’s Marijuana Tax Introduced In Extra Income Than Alcohol Or Cigarettes Final Yr, New State Report Exhibits appeared first on Marijuana Second.